The IRS has updated a section in its frequently asked questions about the Premium Tax Credit, a refundable credit that helps low- and moderate-income individuals and families afford health insurance premiums.

These FAQs supersede earlier ones that were posted in Fact Sheet 2024-04 on Feb. 9, 2024.

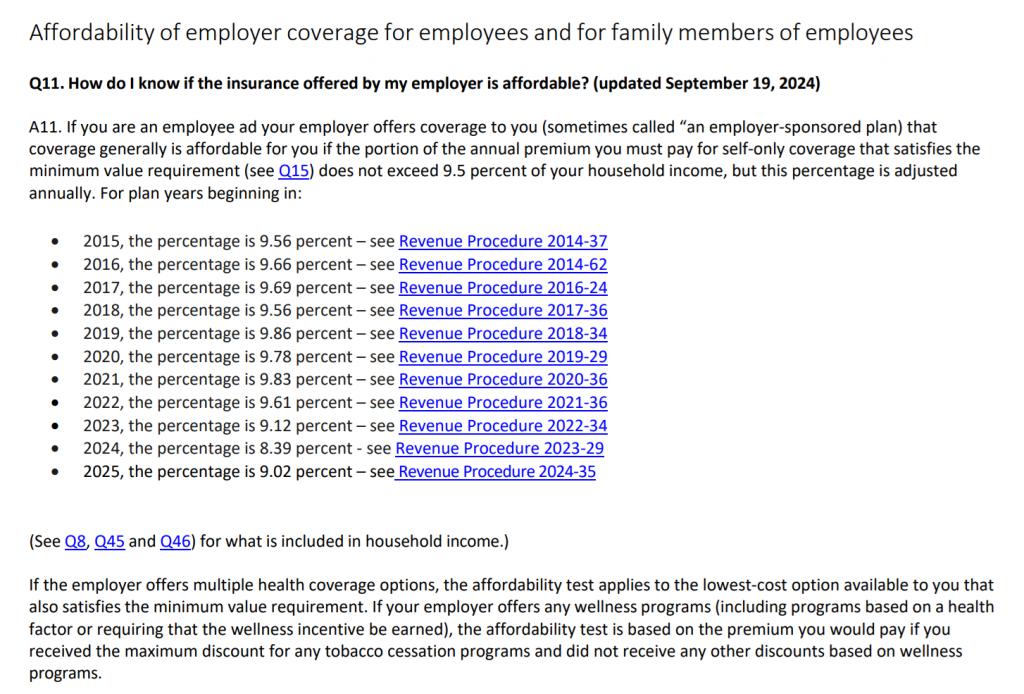

In Fact Sheet 2024-30, which was released by the IRS on Sept. 19, a revision was made under the “Affordability of Employer Coverage for Employees and for Family Members of Employees” section, specifically question 11, to provide the required contribution percentage for determining whether employer coverage is considered affordable for plan years beginning in 2025.

Here’s a screenshot of the information presented in question 11:

The revision is based on Revenue Procedure 2024-35 .

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs